Fortitude Financial Group Things To Know Before You Buy

Fortitude Financial Group Things To Know Before You Buy

Blog Article

A Biased View of Fortitude Financial Group

Table of ContentsUnknown Facts About Fortitude Financial Group6 Easy Facts About Fortitude Financial Group DescribedSee This Report about Fortitude Financial GroupSome Known Questions About Fortitude Financial Group.

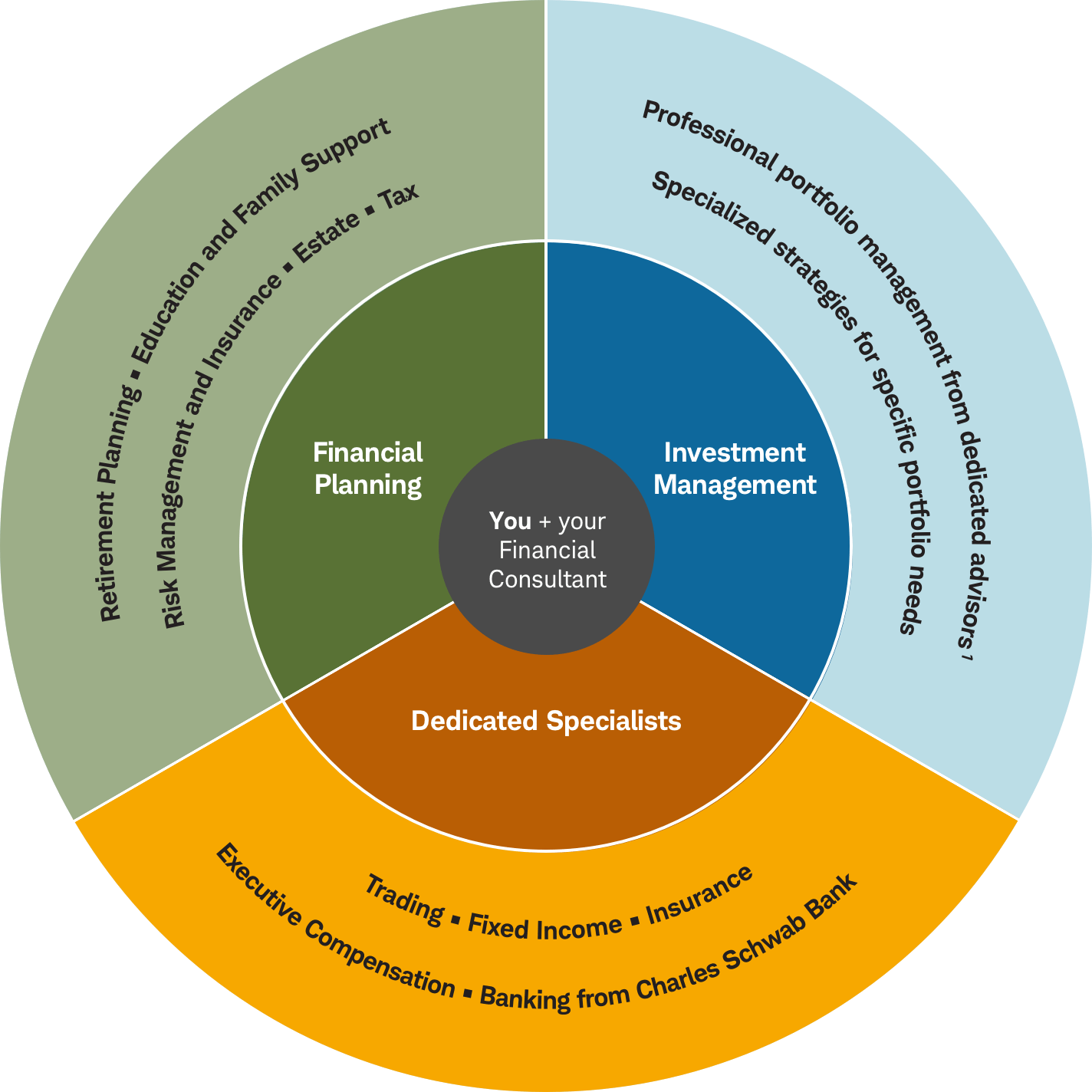

Some will certainly analyze your whole monetary picture and assist you develop a detailed prepare for accomplishing your economic goals. Others, nevertheless, will certainly recommend just the items they sell, which could give you a restricted range of options. Unlike various other professions gone over in this area, the monetary preparation profession doesn't have its very own regulatory authority.For example, an accounting professional - Financial Services in St. Petersburg, FL that prepares economic plans is controlled by the state Board of Book-keeping, and an economic planner who's likewise an financial investment consultant is regulated by the Securities and Exchange Compensation or by the state where the consultant does business. If a planner you're thinking about utilizes a certain specialist classification, have a look at that credential utilizing our Expert Designations lookup device. Various other organizers may hold a credential that is much more challenging to get and to keep, such as the CERTIFIED FINANCIAL coordinator classification, or CFP, provided by the Licensed Financial Organizer Board of Requirements. This certification requires a minimum of three years of experience, enforces rather strenuous standards to gain and keep, permits capitalists to validate the standing of any individual asserting to be a CFP and has a corrective process

An insurance policy agent will tell you regarding insurance coverage items (such as life insurance policy and annuities) but likely won't go over various other financial investment options (such as supplies, bonds or shared funds) - Financial Services in St. Petersburg, FL. You'll want to see to it you totally recognize which locations of your monetary life a specific planner canand cannothelp with before you work with that individual

An Unbiased View of Fortitude Financial Group

Anybody can take advantage of skilled financial adviceno issue where they're beginning with. Our economic consultants will certainly take a look at your big photo. They'll think about all the what-ifs so you do not have to and guide you via life events large and little, like spending for college, acquiring a home, marrying, having a child, adopting a kid, retiring or inheriting possessions.

I approximate that 80% of physicians require, want, and must use a monetary advisor and/or an investment supervisor. Some investment experts such as William Bernstein, MD, assume my estimate is means too low. At any kind of rate, if you wish to use a consultant briefly or for your whole life, there is no reason to really feel guilty concerning itjust see to it you are getting excellent guidance at a reasonable rate.

See the base of the page for even more information on the vetting. Our experts hold at minimum a Ph. D. in Money and Stephan Shipe, the company's lead expert, is additionally a CFA charterholder and CFP Specialist.

Little Known Questions About Fortitude Financial Group.

Together, we will certainly navigate the intricacy of everyday life by crafting a structured financial strategy that check my reference is agile for your progressing needs - https://packersmovers.activeboard.com/t67151553/how-to-connect-canon-mg3620-printer-to-computer/?ts=1724660284&direction=prev&page=last#lastPostAnchor. We will certainly assist you use your riches to release up energy and time to concentrate on your household, your technique, and what you like most. Chad Chubb is a Licensed Financial Coordinator (CFP) and Certified Pupil Funding Professional (CSLP)

He started WealthKeel LLC to simplify and arrange the financial lives of physicians across the United States by custom-crafting economic plans centered around their objectives and values. WealthKeel is acknowledged by The White Layer Investor as one of a couple of select firms classified as "a good monetary expert at a fair cost," for their flat-fee registration model and likewise their capped fee structure.

($9,500) for All. Team up with us if: You're retired or will retire in the next 7 years You have a complete portfolio of $2M+ You're concerned regarding creating & securing revenue for life You wish to handle the 10+ vital retirement earnings dangers extra proactively You don't like problematic charge frameworks (% of properties, flat yet tiered, commissions) We'll build you a custom-made.

Things about Fortitude Financial Group

We can help you create a cost savings and financial investment strategy, so you recognize where to place your added income. We can also assist with different elements of your economic life consisting of financial debt monitoring (student financing preparation), tax obligation preparation, and investment techniques. Our objective is to establish the most efficient and versatile method for clients to develop riches and reach their monetary goals.

Physicians have special economic problems that can occasionally really feel overwhelming. As residents, others, and early-career doctors, you deal with squashing trainee funding debt and completing monetary objectives like starting family members and getting homes.

Report this page